GOGO - Investment thesis: Significant catalysts ahead for this small cap flying above the Radar

Recent transformative M&A + Months (weeks) Away from launching 2 initiatives (5G and LEO) what are transforming Business Aviation industry

Hi there!

This week

The Week in the Markets: One pager with a concise summary of the markets plus the highlights of the week regarding macroeconomy, liquidity, commodities, Earnings season…

Introduction to in-flight connectivity industry - Brief introduction to better understand the different technologies (land/ satellite) used in the industry and the revolution underway to deliver fast, reliable onboard connectivity.

Overview of Business Aviation - Summary of a very interesting industry with steady growth. Types of aircraft, main companies,...

GOGO - Investment thesis of a company that has just closed a transformative acquisition and will launch two cutting-edge initiatives for the Business Aviation inflight connectivity industry in a few months, which is under pressure due to the emergence of Starlink. We analyze the size of the opportunity, put numbers to the scenarios we see, and review in detail the risks that are present. We have been patiently waiting for this situation for a year.

Portfolio Management: Including updates on our 3-stage monitor, comments on several companies, and our macro views, along with their respective movements in both equities and all asset portfolios

Wine industry (supply chain) - Earnings results and industry trends

Data Center

Note: Next week’s email includes an announcement we have been working on since the start of the MORAM project in 2020. Atentos ;)

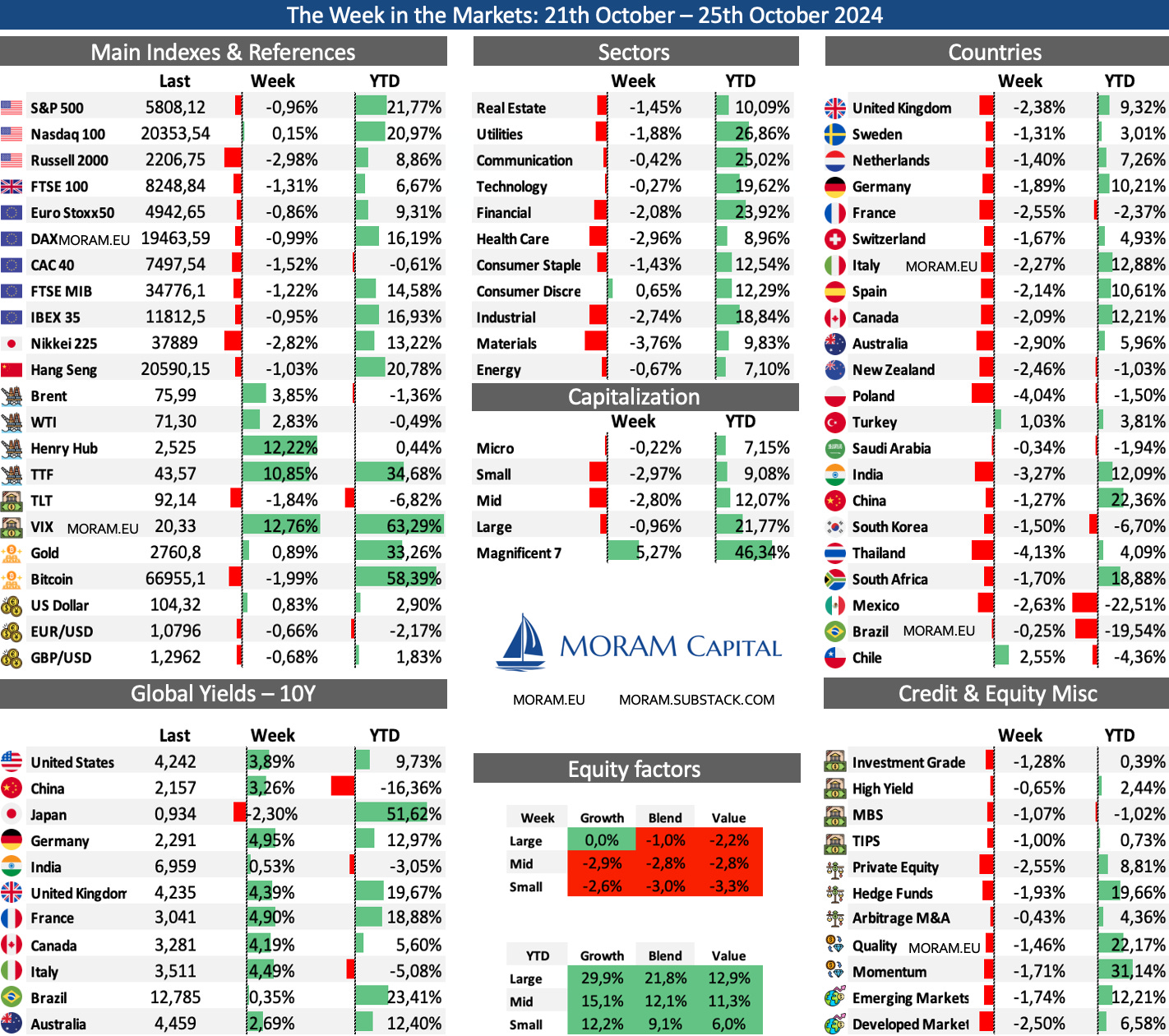

The Week in the Markets

A very light week for macroeconomic data, where most markets finished in the negative, with the rise in 10-year bond yields being the main driver of this performance. Expectations for interest rate cuts in the US have fallen significantly (see graph below) due to a combination of high US fiscal spending (regardless of the new president), the strength of economic data in recent weeks, and a rebound in inflation (which we believe is temporary and, along with the labor market, should continue its cooling trend).

The highlight of the week has been Tesla's performance, which rose more than 20% after reporting very strong results and increasing sales expectations for 2025. This, along with NVIDIA (once again the most valuable company in the world), has caused the Mag7 to widen the gap even further with other segments by capitalization this year. By sectors, there’s little to comment on, it’s clear that Tesla is part of Discretionary Consumption (“Best stocks of the week” graph below).

The Equity Factors table clearly reflects what the week has been like. It was very bad for mid and small caps, while large caps fell but very slightly, clearly distinguishing between growth, which closed even in the green, and value, which dropped alongside the other segments.

A very good week for commodities, especially for European natural gas (2024 highs due to 5.1 mmcm/d halt in Norway and geopolitical tension) and US natural gas, despite the fundamentals really pointing in the opposite direction.

We saw again a typical pattern during negative weeks for the markets, where gold, the dollar, and the VIX closed positively. We are two weeks away from the US presidential elections, and although recent polls show a clear winner, we do not expect volatility to spike (we have been discussing various strategies for this for months, all of which are proving quite effective).

Highlights of the week

As we can see, the change in expectations over the last month regarding interest rate cuts has been quite considerable, especially in this last week. Shortly after the last rate cut, the market expected two more cuts to finish the year and end 2025 around 300 bps; now, only one rate cut is anticipated in December (meaning rates will be held in November) and just three throughout 2025.

The main driver of these movements is that October has been a month with fairly good macro data, both in terms of employment and PMIs. Additionally, the CPI came in slightly above expectations. However, we suspect that the employment data has some electoral character and that the CPI will continue to decrease toward the target in the coming months. After the volatility of the elections, what could mainly support this rise in yields and lower expectations for rate cuts is the high fiscal spending in the US (which both candidates are advocating), but a divided Congress would likely curb significant fiscal initiatives, stabilizing long-term yield expectations. For now, there is volatility, and in two weeks, we will have a clearer picture. This is a topic too relevant not to monitor weekly.

Another relevant point we want to highlight is the huge volume of money currently held in Money Market Funds. In the past, we’ve observed that a significant portion of these assets flows into the stock market when interest rates start to decline (as Money Market Funds yield lower returns). We believe this pattern can repeat in the coming months.

Europe

Eurozone business activity remained weak in October, with declining new orders and a composite PMI at 49.7, slightly above September’s 49.6 but still indicating contraction. France and Germany were significant contributors to this slowdown.

Following comments from several central bankers (France, Portugal, Finland, etc.) this week regarding the risk that the ECB may be falling behind the curve, a 50 bps cut for December has been put on the table, although, for now, everything points towards a 25 bps cut

Japan

Ahead of Japan’s general election on this Sunday, the yen weakened against the USD. Core CPI, rose 1.8% YoY in October, slightly above expectations but lower than September’s 2.0%.

Some interesting Data about markets this week & YTD

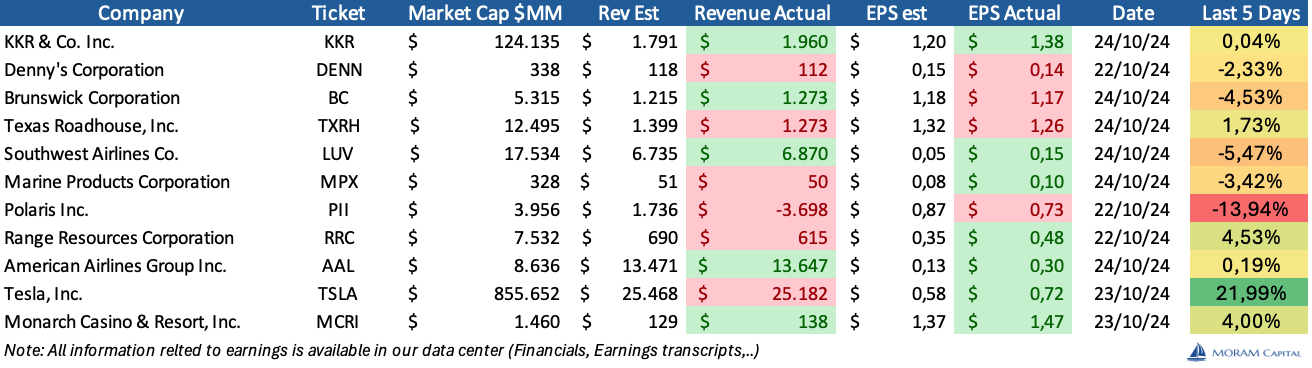

Earning Season

As we mentioned, Tesla has been the standout company of the week, beating market expectations and announcing that it expects a sales increase of between 20% and 30% for next year. Similarly, we have observed ongoing weakness in the discretionary consumer sector, particularly in industries that were greatly boosted by post-COVID effects, such as RVs, which seem likely to face several more difficult quarters. Data from boat manufacturers has also been poor, although they have been less punished in the market.

We will publish updates for restaurants and boat manufacturers to track this earnings season. Additionally, we recently added another person to the team - Iñigo - who, among other things, will handle everything related to the beverage industry (where we will cover the entire supply chain, from glass, barrels, and grapes… to other alcoholic beverages beyond wine).

This upcoming week is one of the most important of this earnings season—not only due to the high number of companies reporting but also because nearly all of the Mag7 (Apple, Microsoft, Amazon, Meta, and Alphabet) will release their results.

Introduction to the in-flight connectivity & Business Aviation industries

GOGO operates in the in-flight connectivity industry - this means being able to connect to the internet during flights to browse, make video calls, watch Netflix,.. - which has been experiencing a huge growth in the recent years - while penetration rate is still very low - as well as genuine revolution with the arrival of new technologies.

There are several technologies that provide connectivity to aircraft, which we can group into two categories:

From Land

Planes equipped with land-based antennas receive signals as they fly over terrestrial areas. As the plane moves, the antennas switch from one tower to another, much like a mobile phone does during a car journey.

ATG (Air-to-Ground): ATG technology enables onboard connectivity by using ground-based towers, similar to cell towers, to transmit signals to the aircraft. This system provides connectivity as long as the plane is within range of ground towers, but it does not work in areas without terrestrial infrastructure, such as over oceans or remote deserts.

5G: 5G connectivity on aircraft is an evolution of ATG technology. By directly connecting aircraft antennas to 5G towers on the ground, this system can provide much higher data speeds and lower latency than traditional ATG, allowing for data-intensive applications such as video calls and HD video streaming. GOGO is expected to be the first company to launch this technology for the Business Aviation industry in 2025

From Satellite

In contrast to land-based towers, satellites enable connectivity over wide areas, including remote regions and oceans. This is generally a significant advantage, though it’s important to consider the high percentage of private jets that are not used for oceanic travel when calculating market figures.

GEO: Geostationary Earth Orbit technology uses satellites positioned at a high altitude of approximately 35,786 kilometers above the Earth's equator. These satellites orbit at the same rotational speed as the Earth, allowing them to remain fixed over a single point on the Earth's surface. The high altitude results in greater latency, which can cause noticeable communication delays. While GEO is suitable for providing consistent coverage over large areas, the latency and lower data speed compared to LEO make it less ideal for applications requiring real-time responsiveness, such as video calls or online gaming.

LEO: Low Earth Orbit satellite technology uses satellites orbiting at a lower altitude (between 500 and 2,000 km above Earth) to provide continuous in-flight connectivity. Unlike geostationary satellites, which orbit much farther away, LEO satellites are closer to Earth, reducing latency and improving data transmission speeds.

There is also MEO (Medium Earth Orbit), but we will not go into detail as we merely talk about it later in the thesis.

For an aircraft to connect to one of these networks, generally (specific requirements depend on each company), a connectivity system and an antenna are needed (both are one-off costs)—what Gogo refers to as Equipment revenues. Then, a monthly or annual subscription is contracted depending on the chosen data plan (service revenues).

We are simplifying the industry economics quite a bit, but it can be deduced that switching costs are high (resulting in a low churn rate), and forecasting revenues, while not straightforward due to the emergence of new technologies & competitors, is easier than in other industries.

Now, there is a company (Starlink) that is shaking the industry with its aggressive entry (it offers high speed via LEO satellites) with a main focus on commercial airlines due to the larger size of its antennas and difficult installation in private (smaller) planes, although it is already working on more compact equipment. However, the cost of Starlink (compared to GOGO Galileo) is considerably higher.

The Business Aviation Industry

GOGO operates in the market of Business aviation (not commercial planes), which is why, before starting the analysis of GOGO, we think it is relevant to provide a brief introduction to the private aviation industry and share its main numbers, so we can then delve into more detail.

The Business Aviation industry is primarily located in the United States, where 63% of the fleet of 23,000 aircraft resides. This number has grown at a practically constant rate (with the exception of the years leading up to the 2008 crisis) with the addition of about 700 new units to the market.

Similarly, among manufacturers, Textron, Bombardier, GulfStream, and Embraer stand out, holding 80% of the market share between them over the last 10 years.

The best-selling aircraft (families) during these years have been (in order):

Gulfstream Gulfstream 450 / 500 / 550 / 600 / 650 / 650

Bombardier Challenger 350 / 650

Cirrus SF50

Bombardier Global 5000 / 5500 / 6000 / 6500 / 7500

Textron CE-680A Citation Latitude

Another important point is that these aircraft are divided into Heavy, Mid, and Light (varying their connectivity needs and the dimensions of the antennas they can integrate).

Heavy Jets: Heavy jets are large aircraft designed for long-distance flights and capable of transporting more passengers and cargo. Generally, these jets can carry between 10 and 19 passengers, with a range that allows them to fly distances of up to 11,100 kilometers without stopping. Notable examples of heavy jets include the Gulfstream G650, Bombardier Global 7500, and Dassault Falcon 8X.

Mid-Size Jets: Mid-size jets are smaller than heavy jets but still offer a good combination of range and capacity. They are ideal for regional and transcontinental business travel. These jets usually accommodate between 6 and 10 passengers, with a range typically between 5,500 to 8,300 kilometers. Examples of mid-size jets include the Cessna Citation XLS+, Bombardier Learjet 75, and Embraer Praetor 600.

Light Jets: Light jets are smaller and more economical aircraft, perfect for short trips and regional flights. They tend to have lower operating costs and are more efficient over shorter distances. Light jets can generally transport between 4 and 6 passengers and have a range of approximately 2,800 to 4,600 kilometers. Examples of light jets include the Cessna Citation Mustang, Embraer Phenom 100, and HondaJet.

A point we think is important to highlight is that only about 35% of the industry has onboard connectivity, so in the coming years, this market is expected to continue expanding.

GOGO - Investment Thesis

We have analyzed GOGO several times in the past, and at the end of 2023, we concluded that it was not attractive at the moment since we did not see catalysts in 2024 for the stock, but that we would analyze it in detail again in 4Q24 since really everything good should happen from then on. In fact, we included GOGO as one of the 8 special situations we reviewed this summer and reiterated that we are still waiting and that we should stick to the plan to analyze it in detail in 4Q24.

Not only is it now 4Q24 and the launch of both 5G and LEO has not been delayed, but on September 30, they announced the acquisition of Satcom Direct - a company larger than GOGO itself - and since the acquisition, we have been very active discussing GOGO in the Portfolio Management section.

Today we want to recap the situation and the new economics (Post M&A and Pre-launch of 5G and LEO (Galileo HDX)) to assess the potential of the existing opportunity and the risks that could undermine the thesis.

As always, we share the financial model of it and explain in detail both the valuation and our strategy to try to maximise the returns from the opportunity.